Table of Contents

- Introduction

- Systematic Investment Plan (SIP)

- Understanding Stock Market Investment

- The Power of Compounding

- SIP vs. Lump Sum Investment

- FAQ

Introduction

When it comes to managing our finances, salary income is often seen as a source of savings. Many people tend to invest their savings in fixed deposits (FDs) due to their perceived safety and reliability. However, it is important to explore other investment options that have the potential for greater returns.

One such option is investing in the stock market. While there is a common belief that the stock market is risky, it is essential to understand that with risk comes the potential for wealth creation. Investing in the stock market allows individuals to participate in the growth of companies and the economy as a whole.

Addressing common doubts about the risk factor, it is important to note that while there are fluctuations in the market, a disciplined and patient approach can help mitigate these risks. By adopting a systematic investment plan (SIP), individuals can invest a fixed amount at regular intervals, averaging the cost of investment over time.

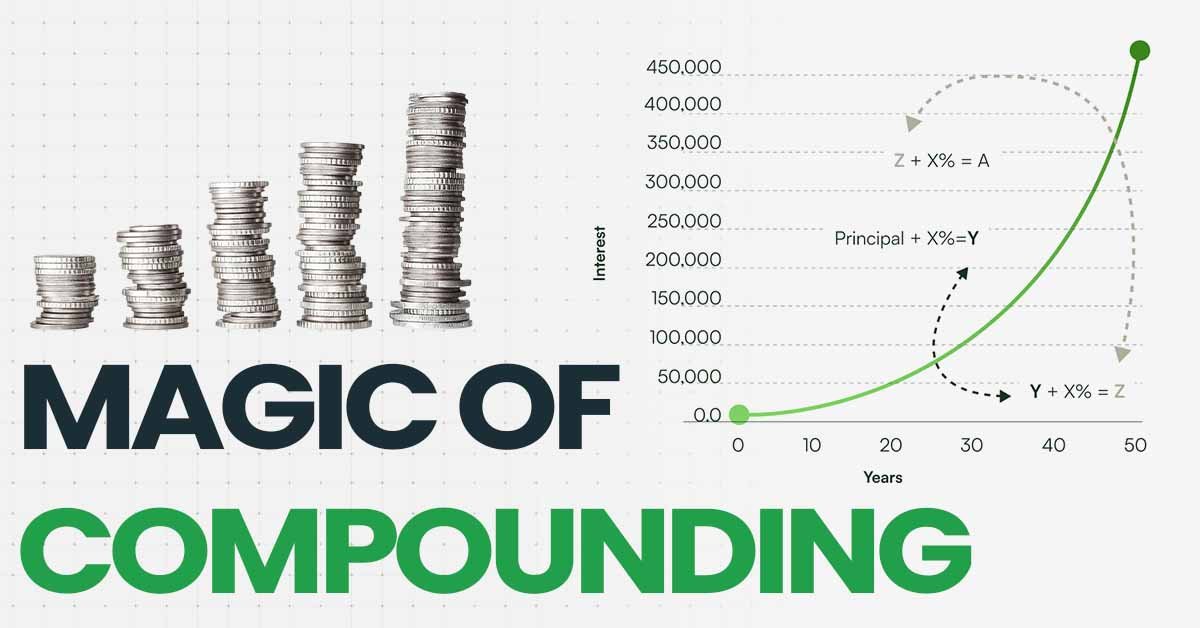

By investing in mutual funds or index funds, which have historically provided an average return of 12-15%, individuals can take advantage of the magic of compounding. Compounding refers to the process of reinvesting your earnings, leading to exponential growth over time. This means that even a small initial investment can grow significantly over a period of several years.

It is important to understand that investing in the stock market requires patience and discipline. By consistently investing a portion of your salary every month, you can benefit from the power of compounding and potentially create significant wealth over the long term. By ignoring short-term market volatility and focusing on long-term goals, you can take advantage of market fluctuations and benefit from rupee cost averaging.

Overall, investing in the stock market has the potential to generate higher returns compared to traditional savings options like FDs. With proper knowledge and understanding, individuals can navigate the stock market and harness the power of compounding to achieve their financial goals.

Systematic Investment Plan (SIP)

A Systematic Investment Plan (SIP) is a disciplined approach to investing in the stock market. It allows individuals to invest a fixed amount at regular intervals, averaging out the cost of investment over time. By adopting a SIP, individuals can mitigate the risks associated with market fluctuations and take advantage of the potential for wealth creation.

To start a SIP, one must first open a Demat account. A Demat account is an electronic account that holds shares and securities in digital format. The process of opening a Demat account is simple and can be done through a bank or a stockbroker. Once the Demat account is opened, individuals can proceed to invest in index funds or mutual funds through their SIP.

Index funds are investment funds that aim to replicate the performance of a specific index, such as the Nifty 50 or the Sensex. Mutual funds, on the other hand, are investment funds managed by professional fund managers who invest in a diversified portfolio of stocks. Both index funds and mutual funds have historically provided an average return of 12-15%.

One of the key benefits of SIP is the power of compounding. By consistently investing a fixed amount every month, individuals can benefit from the compounding effect, which refers to reinvesting earnings to generate exponential growth over time. Even a small initial investment can grow significantly over several years.

It is important to start a SIP early to maximize its potential benefits. By starting early, individuals have more time to take advantage of the compounding effect and can potentially generate higher returns. The longer the investment period, the greater the wealth creation potential.

In conclusion, a Systematic Investment Plan (SIP) is a disciplined approach to investing in the stock market. It allows individuals to invest a fixed amount at regular intervals, averaging out the cost of investment over time. By investing in index funds or mutual funds through SIP, individuals can potentially generate average returns of 12-15%. Starting a SIP early is important to maximize the benefits of compounding and achieve long-term financial goals.

Understanding Stock Market Investment

Investing in the stock market can be a lucrative way to grow your wealth over time. However, it is important to understand the basics of stock market investment before diving in. In this section, we will explore the key aspects of stock market investment, including the difference between investing in funds and individual stocks, the concept of NAV and its impact on fund investments, market fluctuations, and real-life investment experiences.

Difference between investing in funds and individual stocks

When it comes to stock market investment, you have two main options: investing in funds or individual stocks. Investing in funds, such as mutual funds or index funds, allows you to diversify your investment across multiple stocks, reducing the risk associated with investing in individual stocks. On the other hand, investing in individual stocks gives you the opportunity to choose specific companies that you believe will perform well.

Explanation of NAV and its impact on fund investments

NAV, or Net Asset Value, is a key factor to consider when investing in funds. NAV represents the per-share value of the fund’s assets minus its liabilities. The NAV of a fund fluctuates based on the performance of the underlying stocks in the fund’s portfolio. When you invest in a fund, you will buy shares at the NAV price. It is important to track the NAV of your chosen fund as it directly impacts the value of your investment.

Illustration of investing in funds with an example

Let’s say you decide to invest in a mutual fund with an NAV of Rs.50 per share. You invest Rs.5000, which allows you to buy 100 units of the fund. Over time, if the market goes up and the NAV of the fund increases to Rs.90, the value of your investment will also increase. By regularly investing in funds and taking advantage of market fluctuations, you can potentially grow your investment significantly over the long term.

Explaining market fluctuations and their effect on fund NAV

The stock market is known for its volatility, and market fluctuations can have a direct impact on the NAV of funds. When the market goes up, the NAV of the fund increases, and vice versa. It is important to understand that market fluctuations are a normal part of investing and should not be a cause for concern. By staying invested in funds and adopting a long-term perspective, you can ride out market fluctuations and potentially benefit from them.

Examples of real-life investment experiences

Real-life investment experiences can provide valuable insights into the world of stock market investing. Many individuals have achieved significant wealth creation through disciplined investing in funds. For example, let’s consider a person who started a systematic investment plan (SIP) with Rs.5000 per month in a mutual fund. Over a period of four years, their investment grew to almost double the initial value, generating an annual return of 17.98%. This illustrates the power of compounding and the potential for wealth creation through consistent investing.

In conclusion, understanding the basics of stock market investment is crucial for successful investing. By differentiating between investing in funds and individual stocks, grasping the concept of NAV and its impact on fund investments, comprehending market fluctuations, and learning from real-life investment experiences, you can make informed investment decisions and maximize the potential for wealth creation.

The Power of Compounding

Compounding is a powerful concept in investing that can lead to exponential growth over time. It refers to the process of reinvesting your earnings, allowing your investment to generate earnings on top of earnings.

The importance of compounding cannot be overstated. By reinvesting your earnings, your investment can grow significantly over a period of several years. Even a small initial investment can turn into a substantial amount over time.

Let’s take a real-life example of compounding in mutual fund investments. Suppose you start a systematic investment plan (SIP) with Rs.5000 per month in a mutual fund. Over a period of four years, your investment grows to almost double the initial value, generating an annual return of 17.98%.

This demonstrates the exponential growth potential of compounding. By consistently investing a fixed amount every month and taking advantage of market fluctuations, you can potentially create significant wealth over the long term.

Exponential thinking is crucial in investing. By understanding the power of compounding, you can embrace a long-term perspective and focus on the potential for exponential growth. This mindset allows you to ignore short-term market volatility and make informed investment decisions.

Patience and discipline are key when it comes to investing. By staying invested in the market and consistently contributing to your investment, you can benefit from the power of compounding. It is important to have a long-term outlook and avoid making impulsive investment decisions based on short-term market movements.

In conclusion, compounding is a powerful force that can significantly impact your investment returns. By understanding the importance of compounding, embracing exponential thinking, and practicing patience and discipline, you can harness the power of compounding to achieve your financial goals.

SIP vs. Lump Sum Investment

When it comes to investing in the stock market, there are two main approaches: Systematic Investment Plan (SIP) and lump sum investment. Both methods have their pros and cons, but SIP offers several advantages, especially in volatile markets.

Explanation of Rupee Cost Averaging

SIP involves investing a fixed amount at regular intervals, regardless of market conditions. This strategy allows investors to benefit from rupee cost averaging. By investing a fixed amount regularly, investors buy more units when prices are lower and fewer units when prices are higher. This averaging effect helps reduce the impact of market fluctuations on the overall investment.

Comparison of SIP and Lump Sum Investment

Lump sum investment, on the other hand, involves investing a large amount of money in one go. While this approach can potentially yield higher returns if the market performs well, it also exposes the investor to the full impact of market volatility. SIP, with its regular investments, helps mitigate this risk and provides a disciplined approach to investing over the long term.

Benefits of SIP in Volatile Markets

One of the key benefits of SIP is its ability to navigate volatile markets. In volatile times, the market can experience significant fluctuations, causing prices to rise and fall rapidly. By investing regularly through SIP, investors can take advantage of these fluctuations. When prices are low, more units are purchased, and when prices are high, fewer units are purchased. This helps investors benefit from market volatility and potentially generate higher returns over time.

Illustration of Market Fluctuations and Its Impact on Investment

Let’s consider an example: Investor A decides to invest a lump sum amount in the stock market, while Investor B chooses SIP. Over a year, the market experienced both ups and downs. Investor A’s investment value fluctuates significantly, whereas Investor B’s investment is relatively stable due to the averaging effect of SIP. At the end of the year, Investor B’s investment may even outperform Investor A’s due to the advantages of rupee cost averaging.

Overall Benefits of SIP over Lump Sum Investment

SIP offers several advantages over lump sum investment. It provides a disciplined approach to investing, reduces the impact of market volatility, and allows investors to take advantage of rupee cost averaging. Moreover, SIP encourages regular investing habits and helps individuals achieve their financial goals over the long term.

In conclusion, SIP is a preferred investment strategy for many individuals due to its ability to navigate volatile markets, mitigate risk, and take advantage of rupee cost averaging. By adopting a systematic investment plan, investors can potentially generate higher returns and achieve their financial goals in a disciplined and consistent manner.

FAQ

Addressing common questions and concerns about investing:

What are the risks involved in investing?

Investing in the stock market does come with risks, such as market fluctuations. However, a disciplined and patient approach can help mitigate these risks.

How can I manage risk in my investments?

One way to manage risk is through diversification. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the potential impact of any single investment.

What is diversification?

Diversification refers to spreading your investments across different assets to reduce risk. By investing in a mix of stocks, bonds, and other asset classes, you can minimize the impact of any single investment on your portfolio.

What is market volatility?

Market volatility refers to the rapid and significant price fluctuations in the stock market. It is a normal part of investing and can present both opportunities and risks.

How can I handle market volatility?

The key to handling market volatility is to focus on your long-term goals and avoid making impulsive investment decisions based on short-term market movements. By staying invested and maintaining a diversified portfolio, you can ride out market fluctuations and potentially benefit from them.

What is rupee cost averaging?

Rupee cost averaging is an investment strategy where you invest a fixed amount at regular intervals, regardless of market conditions. This approach allows you to buy more units when prices are low and fewer units when prices are high, averaging out the cost of your investment over time.

How can I benefit from rupee cost averaging?

By consistently investing a fixed amount every month, you can benefit from rupee cost averaging. This strategy helps reduce the impact of market fluctuations on your investments and allows you to take advantage of market lows to accumulate more units.

What is the importance of patience and discipline in investing?

Patience and discipline are crucial in investing. By staying invested in the market and consistently contributing to your investment, you can benefit from the power of compounding and potentially achieve your long-term financial goals.

Why is a long-term investment approach important?

A long-term investment approach allows you to ride out short-term market volatility and take advantage of the power of compounding. By staying invested over the long term, you increase your chances of generating higher returns and achieving your financial goals.

In conclusion, investing in the stock market comes with risks, but by practicing risk management techniques, such as diversification and rupee cost averaging, you can minimize these risks. Market volatility is a normal part of investing, and by remaining patient and disciplined, you can take advantage of market fluctuations. A long-term investment approach is crucial for harnessing the power of compounding and achieving your financial goals. For further analysis and understanding, we encourage you to explore the provided excel sheet. Remember, investing requires patience, discipline, and a long-term perspective.